On Thursday, Feb. 9, 2022, the Carleton College Board of Trustees voted to divest the college’s endowment from fossil fuels. The vote comes at the start of their once-per-term weekend-long meeting. The resolution, created by a trustee working group, was approved by the majority of the board.

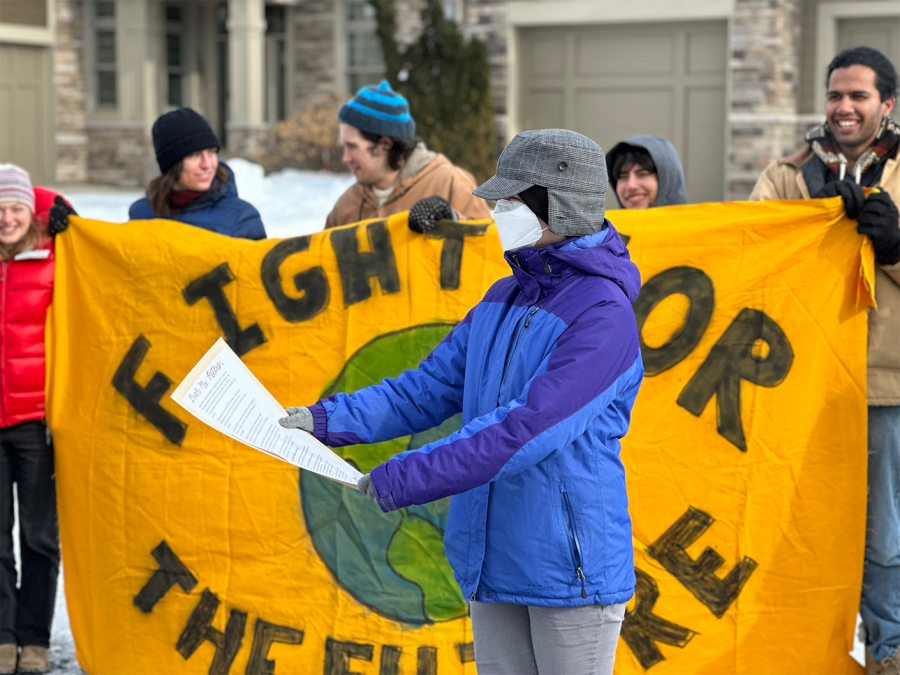

The vote follows nine years of action from alumni, faculty and students. In October, students occupied the Weitz Center for Creativity and marched into a trustees’ meeting to advocate for divestment. This term, student-activists made appearances at trustees’ homes in order to apply even more pressure to divest.

The resolution details, according to a board statement sent out by the President’s Office, commit the college to divesting all direct investments in fossil fuels, which represent around five percent of the total endowment. The divestment will occur through a phasing period from now until 2030.

“The endowment’s allocation to oil and gas investments has steadily declined over the past three years and stands at approximately 5% of the endowment today,” read the statement sent to campus. “We plan for and expect exposure to decrease as we will immediately sell and no longer purchase directly-owned publicly traded fossil fuel companies. Further, we will gradually eliminate private funds that focus exclusively on oil and gas extraction in a prudent manner that is consistent with an overarching emphasis on fiduciary responsibility. Given the illiquid profile of funds of this nature, we anticipate the remaining investments will decline over the next four to five years and will be fully liquidated by 2030.”

The passed resolution commits to divesting public direct holdings, which represent around one fifth to one half of a percent of the endowment, as well as the private oil and gas extraction investments that represent approximately one percent of the portfolio.

“On the public side, I already informed our separately managed account provider, who sub-advises on those positions that Carleton owns directly, the next steps in terms of selling those, so those will be out of the portfolio very soon, if not by the end of today,” said Chief Investment Officer Kelsey Deshler in a press briefing with the Carletonian.

As it stands, five to six percent of the endowment has some fossil fuel exposure. However, as Deshler had previously explained in an interview with the Carletonian, some of those investments attempt to reduce emissions within the fossil fuel industry. Additionally, because there is no secondary market to sell oil and gas extraction investments, these will be ‘rolled off’ and will take between four and five years, but may take up to 2030 to fully divest from.

Under the resolution passed by the Board, a mutual fund that has underlying investments in oil and gas extraction could still be part of the endowment portfolio. This mirrors peer institutions such as Macalester College and St. Olaf College, who also divested from fossil fuels while still allowing mutual funds that have not divested.

The resolution comes from what President Byerly called the “Divestment Working Group,” a subcommittee composed of Deshler, Byerly and four other trustees, including Wally Weitz ’70, the Board of Trustees chair. The working group based their statement and resolution on ample discussions from within the Board.

“Over the years, we talked conceptually about what might go into a statement, but in October at the Board meeting, we talked about ‘if we were to have a resolution, how would people feel about this, having it look this way or that way’ and so on,” Weitz said. “So what they saw today wasn’t a surprise.”

Despite extensive discussion before the proposal was presented, there was still what Byerly described as “vigorous but not heated debate.”

“It was not unanimous,” said Byerly. “Trustees who were concerned about the future of the endowment want to always wish to preserve maximum flexibility, and some raised questions about ‘Does this in fact make a difference to climate change? Does this really change the behavior of actors in the energy industry?’”

None of the holdouts for the divestment vote were pursuing a more aggressive divestment plan.

According to Bestcolleges.com, as of Jan. 31, 2023, over 100 colleges and universities had committed to divesting from fossil fuels. Carleton now joins the list, continuing a legacy of leading in terms of climate-conscious initiatives.

“We’ve been a leader in sustainability, and sometimes that story gets lost because we spent all of our time talking about divestment,” said Byerly. “I feel like our leadership gets undersold in many ways and that we can actually take a stronger position if we’re not having to constantly apologize for not having a clear position on divestment.”

Byerly acknowledged and appreciated the role and energy of student-activists, stating the most effective discussions were ones that happened in one-on-one settings.

Those involved with Divest Carleton and the nine-year-long process saw the plan as evidence of progress by the college.

“This divestment win comes from nine years of committed student and community activism,” said Eliza Lox ’25, one of the students leading the movement. “It’s proof that organizing works, and we hope that this victory empowers students to keep fighting for a better world.”

Eleanor Hall • Feb 12, 2023 at 10:18 pm

Divesting from fossil fuels is very important. But we just have energy. Some of the money gained from divesting should go to investing in renewable energy and energy efficiency stocks.